The Chomp #030

Hey Everyone,

Welcome back to The Chomp—your weekly dose of the best content from the internet and beyond, designed to expand your mind and get you thinking. Let’s dive into it.

Quick Bite

Solving Online Events: “A physical event is a bundle of different kinds of interaction, but it’s also a bundle of people at a certain place at a certain date - as soon as you take these things online, that bundle has no meaning.” (6 Min)

It’s no secret that conferences and live in-person events have are suffering as a result of COVID. As a result, many of these events have shifted online in an attempt to salvage them. After attending several online conferences and seminars over the past few months, it’s become increasingly clear to me that online events are still a long way off from matching their in-person counterparts. While there are certain aspects of conferences that translate well to an online format, such as a talk or presentation, there are many components, such as cocktail hours and chance meetings, that just don’t work online yet.

While I see conferences and other events will likely resuming at some point in the not-too-distant future, I'm confident that online events aren't going to disappear. That leaves a big opportunity in the market for someone to solve them and put them on par with their in-person rivals. How that happens and what those events ultimately look like remains to be seen. I’m certainly excited to see what emerges in the space.

In the above post, Benedict Evans explores this idea in more depth. He makes the following commentary, which I found to be quite interesting:

But every time we get a new tool, we start by forcing it to fit the old way of working, and then one day we realise that it lets us do the work differently, and indeed change what the work is. I do expect to get on planes to conferences again in the future, but I also hope to have completely different ways to communicate ideas, and completely different ways to make connections, that don’t rely on us all being in the same city at the same time - or pretending that we are.

At the end of the day, whatever tools that are built to solve online events shouldn’t be used to fit our current ways of networking and meeting in-person. They should allow us to work in a whole new manner that hasn’t been considered or available in the past.

Deeper Dive

Never Hertz to Ask: “When you see a stock getting bid up like this, the only conclusion you can draw is “The future does not matter, because in between now and then, this is explicitly just spinning a roulette wheel. The stock could go up or down, who knows, but at least you know it has nothing to do with the underlying value of the stock (which we all know is zero!), and everything to do with other gamblers.” (11 Min)

The rise of retail traders has recently become a topic of discussion in the financial world. With the likes of Davey Day Trader Global and Wallstreetbets leading an army of day traders, retail trading has never been more popular. Millions of new investors have flocked to Robinhood and other $0 fee trading platforms throughout the COVID pandemic. The combination of being stuck at home with no sports, nothing to do, and a rapidly rebounding market created a perfect storm type environment for new investors to get hooked on the market. Many of the trades championed by these new investors have centered on either crippled or recently bankrupt companies. One of the most baffling examples being Hertz, which traded up over 500% in three days despite having filed for bankruptcy.

In his most recent post, Alex Danco outlines an excellent theory for what he believes is driving this market activity. His take is one of the best I’ve seen to date on the topic. It goes a long way in helping to understand some of the irrationality we’re seeing in the markets. We’ve entered a bubble type environment where there is a belief amongst these retail traders not that the future will be the same, or different, but that it’s totally irrelevant. Everybody knows that the future expected earnings of Hertz is likely to be $0, but nobody cares. Reality is being suspended. The stock isn’t moving based on upside potential or underlying value. It’s moving based on retail traders spinning a roulette wheel. They’ve realized that the other people bidding the price up are also idiots, and that creates an opportunity to make money.

While the situation surrounding Hertz is unique—and may never be replicated again—the new environment surrounding retail trading is likely here to stay. A new wave of investors has entered the market with 2020 being their introductory experience. It's worth getting acquainted with the rationale driving their behavior—especially if you plan on participating alongside them.

Tweet of the Week

Song of the Week

Apple Music Link

Books

Currently Reading

![Master of the Senate: The Years of Lyndon Johnson III by [Robert A. Caro] Master of the Senate: The Years of Lyndon Johnson III by [Robert A. Caro]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fcea5b62d-58f5-4e63-85bd-a8adaf4315da_331x500.jpeg)

![Wool by [Hugh Howey] Wool by [Hugh Howey]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fc37c3034-40e1-4775-b682-5075d53e84a9_332x500.jpeg)

Recently Read

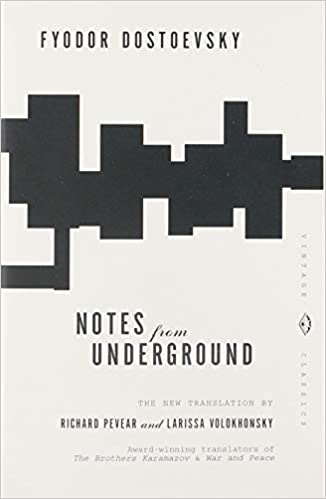

Notes from Underground was my first foray into Dostoevsky’s work. His novels are often considered to be complicated and difficult to follow for someone who hasn’t previously read him, so I settled on Notes from Underground after finding many recommendations pointing to it as the best place to start. Despite having aged more than 150 years, Dostoevsky’s social commentary in Notes from Underground is just as relevant today as it was when he penned the novella in 1684. This is a great starting point for anyone interested in exploring Dostoevsky. (5/5)

![René Girard's Mimetic Theory (Studies in Violence, Mimesis & Culture) by [Wolfgang Palaver] René Girard's Mimetic Theory (Studies in Violence, Mimesis & Culture) by [Wolfgang Palaver]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fbf21607b-7c8f-4719-807c-2cd6362a299f_334x500.jpeg)

René Girard stated in an interview that Wolfgang Palaver's book, René Girard's Memetic Theory, was the most thorough overview of his mimetic theory available. That led me to pick this up as my next read on Girard. It certainly didn't disappoint. While at times a bit dense and technical, Palaver does an incredible job of breaking down and analyzing the mimetic theory. I highly recommend this for anyone with level 1 knowledge of Girard's work that would like to go deeper on his ideas. (4/5)

Parting Thoughts

This Week in History

On June 16, 1903, Henry Ford incorporated the Ford Motor Company. Ford got off the ground with 10 investors and $28,000. It currently has a market cap just north of $25 billion. (Source)

“It is the part of a wise man to resist pleasures, but of a foolish man to be a slave to them."

— Epictetus

If you found something that piqued your interest this week, please help me out in expanding the reach of The Chomp by forwarding it along to a friend or sharing it with others in your network. Until next week.

-CM