The Chomp #017

Hey Everyone,

Welcome back to The Chomp—your weekly dose of the best content from the internet and beyond, designed to expand your mind and get you thinking. Let’s dive into it.

Quick Bites

Antifragility: “The rookie mistake is to confuse antifragility and robustness; the more advanced mistake is to confuse antifragility with optionality. They’re related, but they aren’t the same thing. Options are something you have, whereas antifragility is something you do.” I became familiar with the concept of antifragility after reading Nassim Nicholas Taleb’s book Antifragile about a year and a half ago, and it’s remained stuck in my mind since. Once you familiarize yourself with the power of antifragility you’ll begin to look for it everywhere. This recent piece from Alex Danco offers a great summary of the concept as well as valuable examples of it in action, including in the context of COVID-19. Well worth a read. (6 min)

Finite and Infinite Games: Two Ways to Play the Game of Life: “How you play the game of life will define the learning you pursue. Finite players need training. Infinite players need education.” According to author and professor James Carse of NYU, there are two ways to approach the game of life: as a game with an end, or a game that goes on forever. Whether you choose to play the finite or the infinite game will shape your worldview and also how you define success. Keeping this in mind will help you frame your decisions and ensure you’re making the right choices at whichever game of life you ultimately decide to play. (2 min)

Deeper Dives

Making Uncommon Knowledge Common: “The Rich Barton Playbook is building Data Content Loops to disintermediate incumbents and dominate Search. And then using this traction to own demand in their industries.” Like most others, I’m not too familiar with Rich Barton—he isn’t a household tech name like Jeff Bezos or Mark Zuckerberg. After reading this essay though, I wish I had learned about him much sooner. Barton has founded three $1+ billion consumer-focused companies in Expedia Glassdoor, and Zillow. Having that type of repeatable success is astounding, and I recommend checking out this piece to learn more about the playbook he’s employed in each of his ventures. (13 min)

When to Trust Your Gut: “While instinct coupled with analysis may make a powerful decision-making combination, beware intuition’s pitfalls. Often, your gut is just plain wrong—because it’s subject to biases…Nevertheless, we can learn to avoid these pitfalls—and apply our intuition judiciously to make higher quality choices.” We’re all familiar with the feeling of making a gut or instinctive decision, but I’d be pretty confident in guessing that most of us don’t fully understand the why of how we come to these decisions. This enlightening piece from the Harvard Business Review dives into what our intuition is as well as some high-level science behind it. To be confident in your instinctive decisions, it’s crucial to understand how and why you’re making them—as well as what kind of subconscious biases they might be built on. This article will help you do that. (24 min)

Media

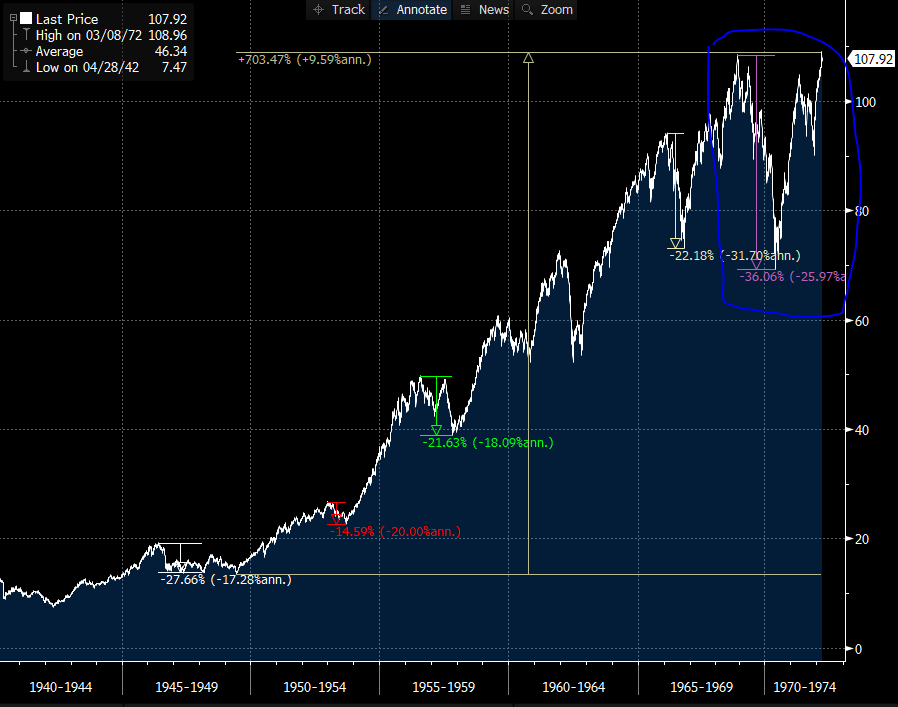

Below is a chart of the S&P 500 before and after the 1969 Hong Kong Flu, which killed about 1 million people globally and 100,000 in the US. The market dropped 36% from all-time highs following a 20-year bull market, which was followed by a V-shaped recovery. While things could play out entirely different with COVID-19, and I by no means would equate the circumstances of each pandemic to each other, this is still an interesting comparison to take a look at.

Tweet of the Week

I root against the Patriots with all of my heart, but I have the utmost respect for Tom Brady and his accomplishments. What he achieved in his 20-year run in New England is unprecedented and will likely never be seen again. Most importantly, he did it in a first-class manner and has been a remarkable ambassador for the game of football. It will be surreal seeing him in another team’s uniform next season.

Song of the Week

Apple Music Link

Books

Currently Reading

Imperial Twilight: The Opium War and the End of China's Last Golden Age (Stephen Platt)

The Power Broker: Robert Moses and the Fall of New York(Robert A. Caro)

This is a 1,344-page behemoth that I’m steadily making my way through. Excited to share my thoughts when I finish in the next couple of weeks.

Recently Read

Zen and the Art of Motorcycle Maintenance: An Inquiry Into Values(Robert Pirsig): This book is a gold mine of philosophical quips and metaphors, but it’s not always easy to get through. You need to be focusing to extract the full value of the ideas that Pirsig presents, and if you’re even the slightest bit distracted you’ll find yourself constantly having to go back and reread what you just read. Even when you are fully focused, it’s still helpful to reread much of his writing to ensure you’re capturing the full breadth of his thoughts. That being said, this one is a modern-day classic for a reason and it’s well deserving of that status. (4.5/5)

Parting Thoughts

This Week in History

On March 19, 2003, the United States, along with coalition forces primarily from the United Kingdom, initiated war with Iraq. The U.S. declared an end to the war in Iraq on December 15, 2011, nearly ten years after the fighting began. (Source)

“Wherever there is a human being, there is an opportunity for a kindness” — Seneca

If you found something that piqued your interest this week, please help me out in expanding the reach of The Chomp by forwarding it along to a friend or sharing it with others in your network. Until next week.

-Cody